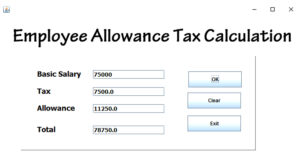

In this tutorials will teach you how to make a Employee Allowance Tax Calculation using Java step by step. Those who wants to learn payroll system this is the right place.

Lets do the Project

Lets Create the three different Functions and do the Calculation

when you calculate the Employee Salary there should be the Condition

if the Basic Salary > 50000/= include Tax 0.1 allowance 0.15

if the Basic Salary > 30000/= include Tax 0.05 allowance 0.1

if the Basic Salary > 15000/= include Tax 0.0 allowance 0.05

public void SalaryCall()

{

double bsal,tax,allo,nsal;

bsal = Double.valueOf(txtbsal.getText()).doubleValue();

if(bsal > 50000)

{

tax = bsal * 0.1;

allo = bsal * 0.15;

}

else if(bsal > 30000)

{

tax = bsal * 0.05;

allo = bsal * 0.1;

}

else if(bsal > 15000)

{

tax = 0.0;

allo = bsal * 0.5;

}

else

{

tax = 0.0;

allo = 0.0;

}

nsal = bsal + allo - tax;

txttax.setText(String.valueOf(tax));

txtallow.setText(String.valueOf(allo));

txttotal.setText(String.valueOf(nsal));

}

public void Clear()

{

txtbsal.setText("");

txttax.setText("");

txtallow.setText("");

txttotal.setText("");

txtbsal.requestFocus();

}

public void Exit()

{

System.exit(0);

}

After that call the Function inside the button

private void jButton2ActionPerformed(java.awt.event.ActionEvent evt) {

SalaryCall();

}

private void jButton3ActionPerformed(java.awt.event.ActionEvent evt) {

System.exit(0);

}

private void jButton1ActionPerformed(java.awt.event.ActionEvent evt) {

Clear();

}

i have attached the video link below. which will do this tutorials step by step.